The third in an ongoing series of conversations, NVTC’s WMATA Board Member Forum is designed…

Regional Gas Tax Before General Assembly

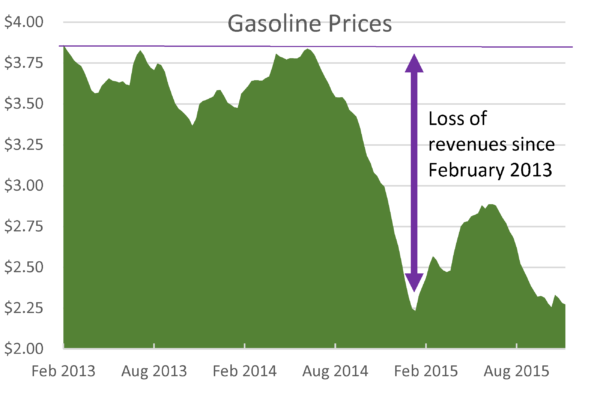

Since 2013, NVTC has experienced as much as a 40 percent drop in monthly motor fuels tax collections – funding used to support capital and operating expenses for transit in Northern Virginia. Because the tax is based on the sales price of fuel, it fluctuates as the price of gasoline rises or falls. The state gas tax has protections to ensure a minimum level of revenue; the regional gas tax does not.

Why the Regional Gas Tax Matters to Local Businesses